will capital gains tax increase in 2021 uk

Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Will capital gains tax increase at Budget 2021.

. What the property tax rate is. Some tax reforms might be pushed later in the year to the fall of 2021. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015.

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean youll pay less in dividend tax and capital gains tax CGT or avoid it all together from 6 April 2021. First deduct the Capital Gains tax-free allowance from your taxable gain. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Tue 26 Oct 2021 1157 EDT First published on Tue 26 Oct 2021 11.

According to the current tax code repairs like painting enhanced curb appeal fixing broken doors or just general selling cost items to get the home ready for selling are not allowed to be deducted from a tax returnHowever increasing the cost basis by tacking on costs for capital. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019. CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget an expert. This is 20000 more than the applicable 500000 home sale tax exclusion.

Will capital gains tax increase. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

Once again no change to CGT rates was announced which actually came as no surprise. Labour has indicated it would increase taxes on. What the property tax rate is and how it could change today The Chancellor has long been rumoured be considering bringing capital gains tax rates.

Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed as of the Budget on 27 October 2021 this was immediately increased to 60 days. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and. Although normally most tax rate changes come into effect on budget day or soon after 2021s tax reforms might need to wait.

Capital gains tax rates for 2022-23 and 2021-22. Strict restrictions for unvaccinated come into effect in Greece. 0400 Sun Oct 24 2021.

Add this to your taxable income. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March.

Consultations on policies that will define the UKs tax strategy for the next 10 years will start on March 23 following the budget announcements. What the property tax is and why rate could change in the 2021 Budget today Capital gains tax is a tax on the profit you make when you sell something that has. The maximum UK tax rate for capital gains on property is currently 28.

At least five changes are coming to the capital gains tax system a letter from the Treasury has revealed. The government will legislate in Finance Bill 2021-22 to extend the deadline for residents to report and pay Capital Gains Tax CGT payment after. UK records 44917 new cases.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. Will capital gains tax increase at Budget 2021. Gains from selling other assets are charged at 10 for.

The governments plans were outlined in its response to the Office of Tax Simplification OTS following several reports it submitted over the last couple of years which outlined its recommendations for how inheritance tax and capital gains tax CGT could be.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

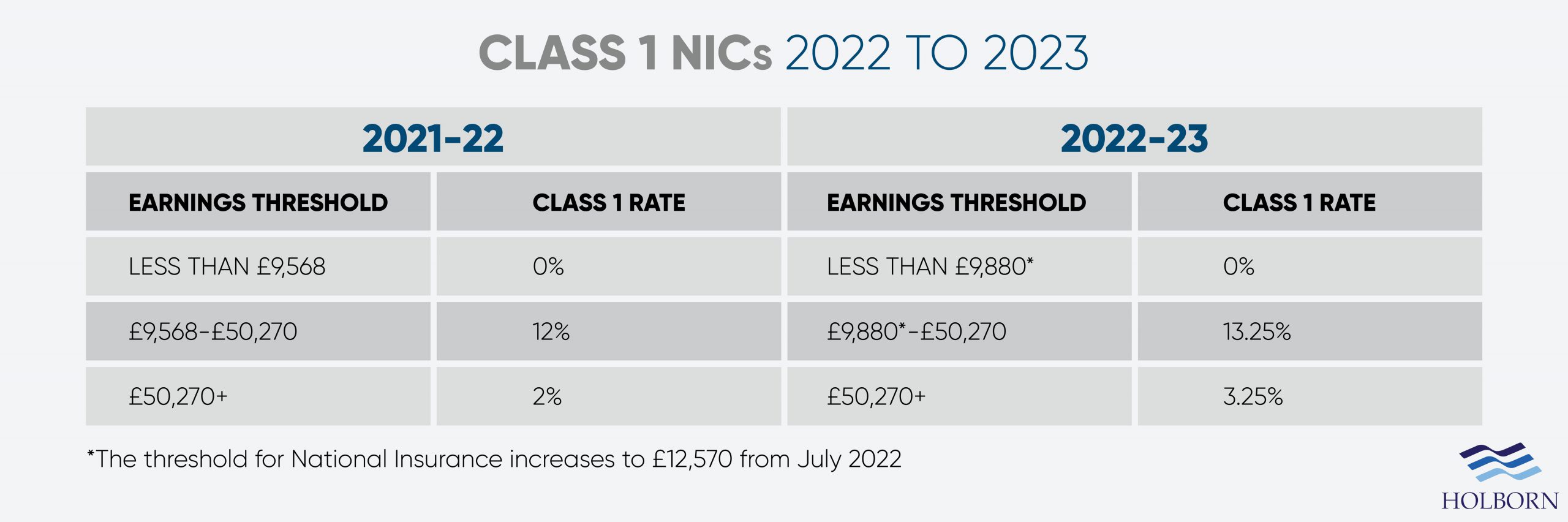

Changes To Uk Tax In 2022 Holborn Assets

Capital Gains Taxes Are Going Up Tax Policy Center

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax When Selling A Property Robert Holmes

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

Corporation Tax Income Forecast Uk 2021 Statista

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

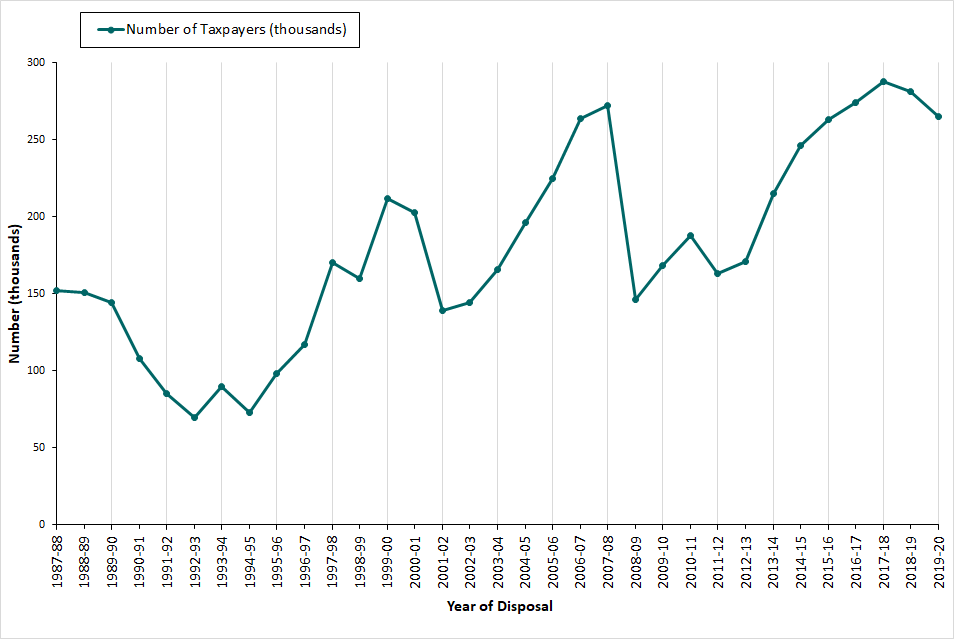

Capital Gains Tax Receipts Uk 2021 Statista

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Changes To Uk Tax In 2022 Holborn Assets

Capital Gains Tax Commentary Gov Uk

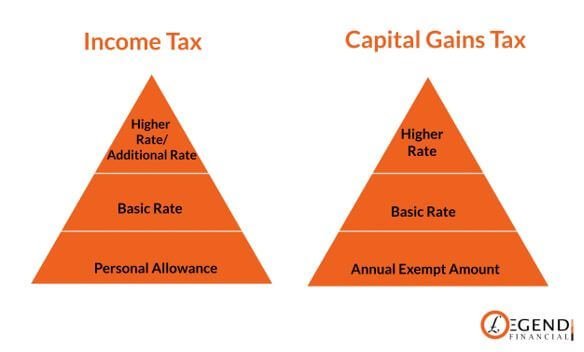

How Much Is Capital Gains Tax On Property Legend Financial

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Capital Gains Tax Commentary Gov Uk

Rishi Sunak Shelves Proposal To Hike Capital Gains Tax Pointing To Burden The Independent